|

| AI in accounting |

Accounting AI- Revolutionizing Corporate Accounting?

The world of corporate accounting, long perceived as a realm of meticulous ledgers, complex spreadsheets, and endless reconciliation, is experiencing a seismic shift. This transformation isn't driven by new regulations or accounting standards alone, but by the rapidly advancing capabilities of Artificial Intelligence (AI). In 2025, AI in accounting is no longer a futuristic concept; it's a present reality, reshaping how businesses manage their finances, gain insights, and make strategic decisions.

This blog post explores the profound ways AI is revolutionizing corporate accounting, moving it beyond historical record-keeping to a proactive, predictive, and strategic function.

Beyond Spreadsheets: How Artificial Intelligence is Revolutionizing Corporate Accounting

1.The Traditional Accounting Landscape: Ripe for AI Disruption:

For decades, corporate accounting departments have grappled with challenges that make them ideal candidates for AI intervention:

- Manual, Repetitive Tasks: Data entry, invoice processing, bank reconciliations, and expense approvals consume countless hours. These tasks are prone to human error and are often monotonous.

- Data Volume and Complexity: Modern businesses generate colossal amounts of financial data from diverse sources, making manual processing and analysis increasingly unwieldy.

- Reactive Reporting: Traditional accounting often focuses on reporting what has happened, providing historical snapshots rather than forward-looking insights.

- Fraud Vulnerability: Manual review processes can miss subtle patterns indicative of fraud, both internal and external.

Enter Artificial Intelligence, poised to address these pain points, ushering in an era of unprecedented efficiency, accuracy, and strategic value for the finance function.

2.Key Pillars of AI Transformation in Corporate Accounting:

The integration of AI in accounting is multifaceted, impacting various aspects of financial management:

Automation of Repetitive Tasks (Robotic Process Automation - RPA)

One of the most immediate and impactful applications of AI in accounting is the automation of high-volume, rules-based tasks through Robotic Process Automation (RPA). RPA bots, often augmented with AI capabilities like optical character recognition (OCR) and natural language processing (NLP), can:

- Automate Data Entry: Extract information from invoices, receipts, and bank statements, and automatically input it into accounting systems.

- Streamline Invoice Processing: Match purchase orders to invoices, verify details, and initiate payments without human intervention.

- Expedite Bank Reconciliation: Automatically compare bank statements with ledger entries, flagging discrepancies for human review.

- Manage Expense Reports: Process and approve employee expense claims based on predefined policies.

- Impact: This dramatically reduces processing time, minimizes human error, and frees up accounting staff from mundane tasks, allowing them to focus on more analytical and strategic work.

Enhanced Accuracy and Error Reduction

Human error is inevitable, especially when dealing with large volumes of data. AI in accounting significantly mitigates this risk by:

- Real-time Validation: AI algorithms can continuously cross-reference data from various sources, identifying inconsistencies or errors as they occur, rather than at month-end.

- Anomaly Detection: Machine learning models can spot unusual transactions, incorrect entries, or deviations from normal patterns that a human might miss.

- Standardization: AI helps enforce consistent data entry and processing rules across the organization, leading to cleaner, more reliable financial data.

- Impact: Improves the integrity of financial data, leading to more accurate financial statements and reduced need for time-consuming error correction.

Predictive Analytics and Forecasting

Moving beyond historical reporting, AI in accounting empowers organizations with foresight. AI models can analyze vast historical and real-time data sets to:

- Predict Cash Flow: Forecast future cash inflows and outflows with greater accuracy by considering market trends, economic indicators, and historical spending patterns.

- Assess Financial Risk: Identify potential financial risks, such as supplier defaults or customer payment delays, allowing for proactive mitigation strategies.

- Revenue Forecasting: Provide more precise revenue projections by analyzing sales data, marketing campaign performance, and external economic factors.

- Budgeting Insights: Suggest optimal budget allocations based on predictive models of future needs and opportunities.

- Impact: Transforms accounting into a strategic partner, providing actionable insights that inform business decisions, optimize resource allocation, and drive growth.

Advanced Fraud Detection

Traditional fraud detection relies on rules-based systems that can be circumvented by sophisticated fraudsters. AI brings a new level of intelligence to fraud prevention by:

- Pattern Recognition: Machine learning algorithms can identify subtle, complex patterns in transaction data that indicate fraudulent activity, such as unusual spending habits, duplicate invoices, or suspicious vendor relationships.

- Anomaly Detection: AI constantly monitors for deviations from normal behavior, flagging transactions that fall outside established norms for human review.

- Real-time Monitoring: AI systems can analyze transactions in real-time, enabling immediate detection and prevention of fraudulent activities before they cause significant damage.

- Network Analysis: AI can map relationships between entities (employees, vendors, transactions) to uncover hidden fraud rings.

- Impact: Enhances security, reduces financial losses due to fraud, and strengthens internal controls.

Streamlined Compliance and Auditing

The complexities of regulatory compliance are a constant challenge for corporate accounting departments. AI streamlines these processes by:

- Automated Compliance Checks: AI can continuously monitor financial transactions and data against regulatory requirements (e.g., IFRS, GAAP, tax laws), flagging any potential non-compliance.

- Continuous Auditing: Instead of periodic audits, AI enables ongoing, real-time auditing, making it easier to identify and rectify issues immediately, reducing year-end crunch.

- Documentation and Traceability: AI systems can automatically log and trace all transactions and data movements, providing comprehensive audit trails.

- Tax Preparation Efficiency: AI can automate the collection and classification of financial data necessary for tax filings, reducing manual effort and errors.

- Impact: Reduces compliance risk, improves audit efficiency, and ensures adherence to ever-evolving regulatory landscapes.

Intelligent Reporting and Insights

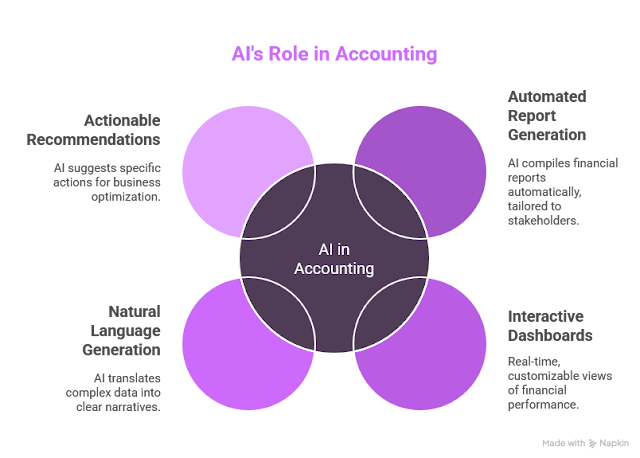

Beyond just generating reports, AI in accounting makes reporting smarter and more actionable:

- Automated Report Generation: AI can compile and generate a variety of financial reports (e.g., P&L, balance sheets, cash flow statements) automatically, tailored to specific stakeholders.

- Interactive Dashboards: AI-powered dashboards provide real-time, customizable views of financial performance, allowing users to drill down into data and explore insights.

- Natural Language Generation (NLG): Some AI tools can even translate complex financial data into clear, narrative reports, making financial information accessible to non-finance professionals.

- Actionable Recommendations: AI can go beyond insights to suggest specific actions, such as optimizing payment terms, adjusting inventory levels, or reallocating budgets.

- Impact: Transforms raw data into accessible, actionable intelligence, enabling faster, more informed business decisions across the organization.

3.The Evolving Role of the Accountant in the Age of AI

The rise of AI in accounting does not spell the end for accounting professionals; rather, it marks an evolution of their role. Accountants are moving away from being data processors to becoming strategic advisors.

- From Doers to Overseers: Accountants will oversee AI systems, ensuring data quality, validating AI-driven insights, and managing exceptions that AI flags.

- Strategic Partners: With AI handling routine tasks, accountants can dedicate more time to advanced financial analysis, risk management, strategic planning, and providing business intelligence.

- Data Interpreters: The ability to interpret complex data, understand AI models, and translate insights into business language will be paramount.

- AI Integrators: Accountants will increasingly be involved in selecting, implementing, and optimizing AI solutions within their organizations.

This shift necessitates a new skill set for accountants, including data analytics, AI literacy, critical thinking, problem-solving, and communication. Continuous learning and upskilling will be vital for career longevity and growth.

4.Challenges and Considerations for AI Adoption in Accounting:

While the benefits are clear, implementing AI in accounting comes with its own set of challenges:

- Data Quality: AI models are only as good as the data they're trained on. Dirty, inconsistent, or incomplete data can lead to flawed insights and errors.

- Integration with Legacy Systems: Many large corporations operate with entrenched legacy accounting systems that can be difficult to integrate with new AI technologies.

- Implementation Cost: Initial investment in AI software, infrastructure, and training can be substantial.

- Talent Gap: A shortage of professionals with combined accounting and AI/data science skills can hinder adoption.

- Resistance to Change: Employees may be hesitant to adopt new technologies that fundamentally alter their roles.

- Ethical Concerns and Bias: Ensuring AI models are fair, unbiased, and transparent in their decision-making is critical, especially when dealing with sensitive financial data.

5.The Future of Corporate Accounting with AI

Looking ahead, AI in accounting will become even more pervasive and sophisticated. We can anticipate:

- Hyper-Automation: Most, if not all, routine accounting processes will be fully automated, requiring minimal human intervention.

- Real-time Financial Intelligence: Businesses will have immediate access to comprehensive, predictive financial insights, enabling agility and proactive decision-making.

- Embedded Finance: AI will facilitate the seamless integration of financial processes directly into business operations, making finance invisible yet omnipresent.

- Autonomous Accounting: While a full lights-out accounting department is still a distant vision, continuous, self-correcting accounting systems will become more common.

- Auditing Evolution: AI will enable a shift from sample-based to continuous, comprehensive auditing, potentially conducted by AI agents themselves.

Conclusion: Embracing the AI-Powered Accounting Revolution

The transformation of corporate accounting by Artificial Intelligence is not merely an incremental improvement; it is a fundamental redefinition of the function. AI in accounting empowers finance professionals to move beyond the confines of historical data entry and reconciliation, leveraging powerful tools for automation, enhanced accuracy, predictive insights, and robust fraud detection.

For corporate entities, embracing this AI-driven evolution is no longer optional but essential for maintaining a competitive edge, optimizing operational efficiency, and securing a strategic future. The accounting profession is evolving, and those who adapt to this AI-powered landscape will emerge as the true strategic navigators of tomorrow's businesses.